Story Highlights

- Mobile gaming is one of the largest media markets in the world.

- Most big gaming developers have failed to make any significant market share despite large investments.

Major AAA publishers and developers have often overlooked the mobile gaming market. This market is currently the largest market for gaming, as mobile devices have become more commonplace and accessible than consoles and high-end PCs.

Big publishers like Take-Two, Ubisoft, and EA own storied IPs that go back decades. Ubisoft plans to release mobile versions of its major franchises, such as Assasins Creed, Rainbow Six, The Division, and more. Take-Two acquired mobile game developer Zynga in a $12 billion deal to get a foothold in the mobile gaming market. Activision has its own offerings with Call of Duty Mobile.

These companies are expanding offerings and investments in mobile gaming. Massive acquisitions, adaptations of AAA titles to mobile devices, and more are allowing major publishers to enter the mobile gaming market. But will it be enough?

The Mobile Gaming Market Is Massive

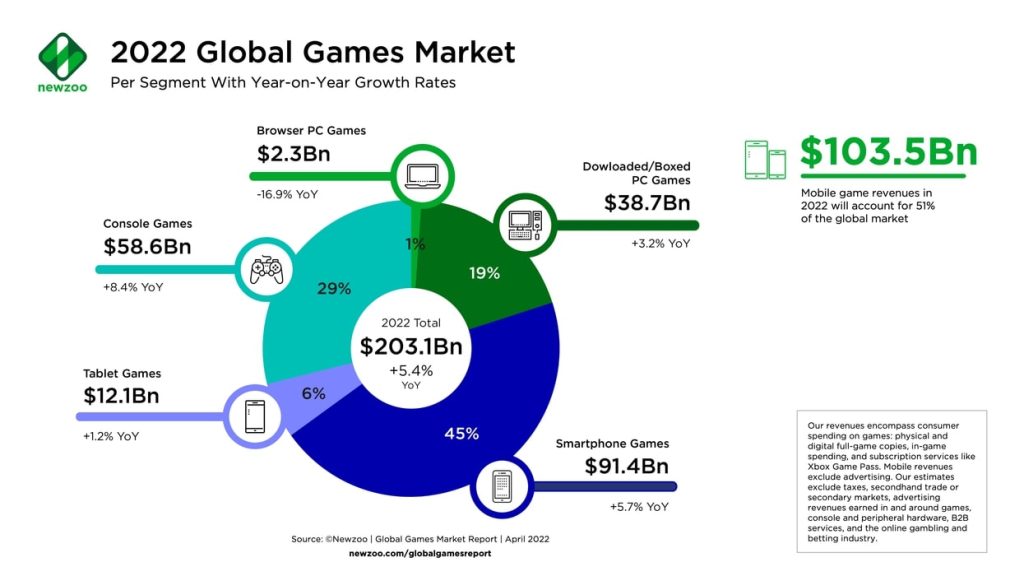

Mobile devices are the largest market for gaming, eclipsing consoles and PC. Revenue from mobile gaming alone is expected to reach over $315 billion this year. More than half of the gaming market exists on mobile platforms, according to the Newzoo 2022 Global Gaming Report. This makes sense, as mobile devices are more accessible in most markets.

There are roughly 4 billion smartphones in the world—likewise, over 100 million PlayStation 4s and 32 million PS5s. Xbox 360, One, X|S, and Nintendo Switch/Wii/Wii U have each sold between tens of millions to 100 million+ units as well. Despite those high numbers, many of these consoles are outdated and no longer in use. While the same can be true about mobile, the mobile market can benefit from the cloud.

In some emerging markets where consoles are not available or are more expensive, consumers may turn to easily available mobile devices for gaming. Cloud gaming will now allow consumers to play the newest AAA games on older hardware without the need for the newest graphics card or console.

Tencent is currently the global leader in mobile gaming, with $27 billion+ in revenue. They are followed by Netease and Gerena, two other Asian gaming giants. Activision Blizzard comes in at 4th place, however, they are an anomaly among western AAA publishers. Activision has found success in mobile games such as Call of Duty mobile, but it is a success other publishers have failed to replicate.

The Mobile Gaming Market Is Diverse, And Products From AAA Publishers Do Not Fit In

The mobile gaming market is very diverse. However, it is dominated by hypercasual games. Think of games like Temple Run, etc. In fact, a majority of mobile games fall into the hypercasual category. The biggest mobile game genre is puzzle games, with a 21% market share. Casino games follow with a 19% market share. RPG and simulation follow with 15 and 10% share, and all other genres are single-digit.

Small, agile teams make the most popular mobile games. The titles do not need to have the scale or budget of their AAA counterparts. In fact, many popular mobile games were made by small teams of one person or a couple of people. Temple Run is one example; the developer couple’s game had hundreds of millions of downloads and players at its peak.

Outside of some games like Call of Duty Mobile, Genshin Impact, and PUBG Mobile, big publishers have not been able to tap into the demand for hit mobile titles. These publishers have increased their product offerings in mobile gaming in recent years, hoping to gain market share; however, something isn’t working. Despite mobile gaming being the largest market, AAA publishers are unable to compete.

One of the major problems for these companies is that there seems to be little interest in mobile adaptions of AAA titles. Recently, EA announced it would be shutting down its flagship mobile title Apex Legends Mobile, also ending the development of a mobile Battlefield game. The company claimed these titles did not meet quality expectations.

Big AAA publishers are looking to develop scaled-down versions of their own AAA console and PC games. Apex and Battlefield mobile both are scaled versions of their AAA counterparts, something necessary to fit the games on mobile devices. However, with the rise of cloud gaming, consumers are able to play console and PC versions of games without having to play a watered-down mobile version.

Cloud gaming currently poses the biggest threat to mobile adaptions of AAA titles. Why play the watered-down version when you could play the original on the same device? Of course, cloud gaming isn’t perfect, and mobile games are optimized for their devices. In the future, we expect cloud gaming technology to become mature and rival the quality of specially adapted mobile games on mobile devices.

Hypercasual games are dominant in the industry. Games like Clash of Clans, Candy Crush, Pokemon Go, and Monster Strike are the highest-grossing mobile games and are far different from the AAA mobile adaptions that studios like EA have been releasing.

Trivial Revenue Is Derived From Mobile Gaming At AAA Publishers

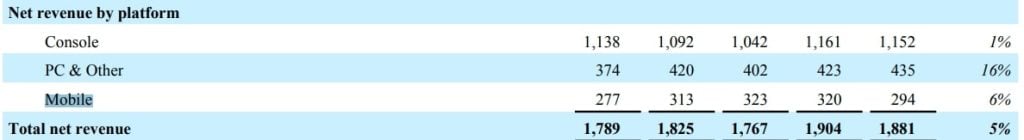

Mobile devices are the highest-grossing and largest market for gaming. However, this market accounts for very little of the revenue of major AAA publishers. EA, for example, receives only a fraction of its revenue from mobile gaming. In QY FY 2023, EA generated $1.8 billion in revenue, $294 million of which came from the mobile gaming segment.

EA’s recent earnings report highlighted why mobile adaptations of AAA titles often do not translate well.

There’s cognitive dissonance in the desire to unite global gaming communities around core IP versus the reality of that IP not always translating so well across platforms,” says Moffett Nathanson analyst Clay Griffin.

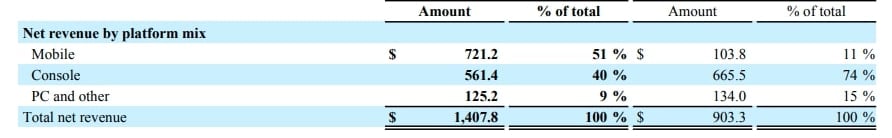

Take-Two Interactive acquired mobile publisher Zynga in order to expand into mobile gaming. Prior to the acquisition, Take-Two generated only $110 million from the mobile segment out of $903 million in 2021. 11% of the company’s revenue had come from mobile gaming. Post-acquisition, that share of revenue had jumped to 51%, with $721 million of revenue coming from mobile.

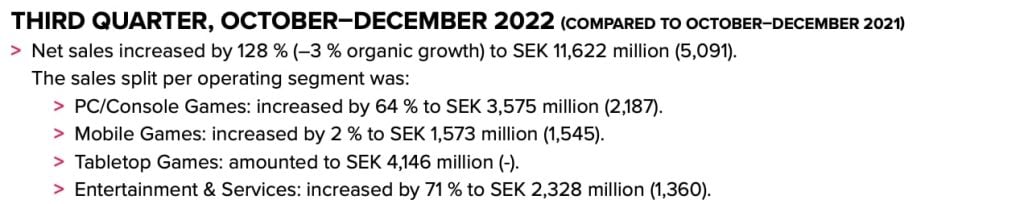

Embracer Group, one of the largest video game companies in terms of studios owned, receives only a fraction of its revenue from mobile gaming through its subsidiaries DECA Games and Easybrain. In the third quarter, the company recorded revenue of SEK 11,622 million. Mobile gaming was only a fraction of that, at SEK 1,573 million.

What Publishers Can Do To Expand In Mobile Gaming

In order to further compete in mobile gaming, publishers should expand their offerings through aggressive acquisitions of mobile gaming companies. Instead of focusing on high-quality, high-budget “AAA mobile games”, publishers should expand downmarket into smaller, hypercasual projects. Small teams are capable of developing games in this market.

Publishers should also avoid adapting popular AAA IPs to mobile devices. History has shown that these adaptations often do not sell well and focus on unique IPs that fit the mold of mobile gaming. To bring their AAA titles to mobile devices, publishers could instead focus on bringing their console and PC titles to mobile by offering their games on cloud services, such as Amazon Luna and Xbox Cloud Gaming.

Thanks! Do share your feedback with us. ⚡

How can we make this post better? Your help would be appreciated. ✍